According to Huizheng Information and data from the BuyChem Research Institute, from mid-September to early October 2025, Chinese titanium dioxide suppliers implemented the fifth round of price increases, raising domestic prices by RMB 300 per ton and export prices by USD 40–50 per ton.

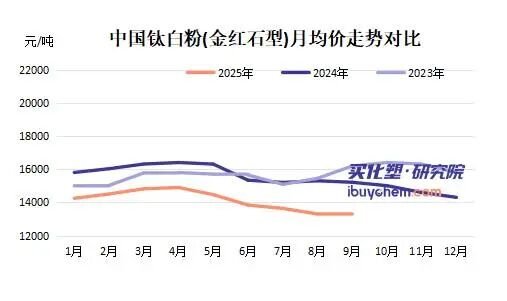

With this round, the cumulative increase has reached RMB 1,900–2,400 per ton. However, actual market prices have declined compared with both the same period last year and the beginning of this year — rutile TiO₂ prices are down 12.55% year-on-year and 6.63% compared with the start of the year. This indicates that there are complex market contradictions behind the price hikes.

At the consumer end, titanium dioxide (TiO₂) is facing weak demand and a breakdown in the price transmission mechanism. The main downstream application of TiO₂ is in architectural coatings, but the sluggish real estate sector has led to insufficient demand in this area. Intense competition in the end-user market has made it difficult for coating manufacturers to pass higher TiO₂ costs on to consumers, resulting in price increase notices that fail to materialize.

According to monitoring by the BuyChem Research Institute, despite multiple rounds of price hikes by producers, weak downstream demand has caused actual market prices to fall instead of rise. This indicates that domestic demand provides limited support, and that the price increases are largely a “passive response” by suppliers rather than being driven by genuine demand growth.

As the world’s largest producer of TiO₂, China has also seen its export volume decline amid growing international trade barriers. From January to August 2025, China’s total TiO₂ exports reached 1.1901 million tons, down 7.95% year on year (a decrease of about 102,800 tons). Among these, exports of chloride-process TiO₂ fell by 3.38%, while sulfate-process TiO₂ exports dropped by 8.96%. The decline is partly due to anti-dumping investigations and tariff barriers imposed by multiple countries (such as India and the EU), which have hampered exports.

At the same time, import data also reflect weakness — total imports stood at 50,500 tons, down 20.16% year on year — suggesting a deteriorating global trade environment and a lack of momentum for China’s export-oriented growth.

While both domestic and export markets are under pressure, TiO₂ producers are also facing rising cost burdens. The main raw materials for TiO₂ production are titanium ore and sulfuric acid. In recent years, due to environmental policies and rising energy prices, upstream costs have continued to climb. For example, titanium ore prices remain high, and energy and environmental costs in the sulfate process have increased.

Suppliers have attempted to pass on these cost pressures through five rounds of price hikes, but weak downstream demand and fierce market competition have instead led to actual price declines. This reflects that cost-push price increases are being constrained by weak demand, further squeezing producers’ profit margins.

On September 13, Venator Asia announced a suspension of production, while several of its European plants were shut down due to the energy crisis and environmental pressures, reducing global titanium dioxide (TiO₂) supply. Theoretically, this should have benefited China’s TiO₂ exports and supported price increases. However, the decline in China’s export data indicates that weak global demand and intensified trade barriers have offset the positive effects of reduced supply.

Chinese TiO₂ producers have attempted to raise prices to gain market share, but with both domestic demand and exports remaining weak, global changes have brought little real advantage.

At present, the five rounds of price hikes reflect suppliers’ struggle under the pressure of rising costs, tightening global supply, and internal market constraints. Yet insufficient demand and export difficulties have greatly undermined the effectiveness of these price increases, leaving the overall market sluggish.

In the short term, the TiO₂ market may continue to experience a situation of “prices without transactions,” and the current round of price hikes is unlikely to be sustainable. To cope with these challenges, producers need to optimize their product portfolios — for example, by developing high-end chloride-process products — and explore emerging markets to create new growth opportunities.