Overall Export Growth Trend

Total Exports: From January to February 2025, China’s cumulative titanium dioxide export volume reached 315,900 tons, a year-on-year increase of 7.52%, marking the highest level for the same period in nearly five years. In February alone, the export volume was 157,500 tons, setting a new record for the past five years.

Reasons for Growth: On one hand, despite the European Union and Brazil imposing anti-dumping duties on Chinese exports in the second half of 2024, China’s titanium dioxide industry has maintained strong international competitiveness, resulting in export growth. On the other hand, the continuous advancement of the “Belt and Road” initiative has effectively mitigated the phase pressure from trade protectionism, promoting the growth of titanium dioxide exports.

Export Situation by Trade Partner

India

- Export Volume: From January to February 2025, China’s titanium dioxide exports to India increased by 62% year-on-year.

- Reasons for Growth: India plans to impose anti-dumping duties on Chinese titanium dioxide at the end of March, with high tax rates. To reduce tax risks, Chinese exporters concentrated their shipments in January and February, while Indian paint factories actively stockpiled, some up to June. However, this growth is mainly for stockpiling purposes, and a significant decline in exports to India is expected in March and April.

European Union

- Export Volume: Over the past five years, China’s titanium dioxide exports to the EU had maintained an average annual growth of 10%, but in 2024, there was a decline, decreasing by 5% year-on-year. From January to February 2025, China’s titanium dioxide exports to Belgium were only 5,800 tons, a sharp decrease of 74% compared to the same period last year. During the same period, exports to Italy were 5,100 tons, down 45%. No EU countries appeared in the top ten export partners for January-February 2025.

- Reasons for Decline: Since July 2024, the EU has imposed anti-dumping duties ranging from $270 to $800 per ton on Chinese titanium dioxide, significantly reducing its competitiveness in the EU market and leading to a substantial decrease in export volume.

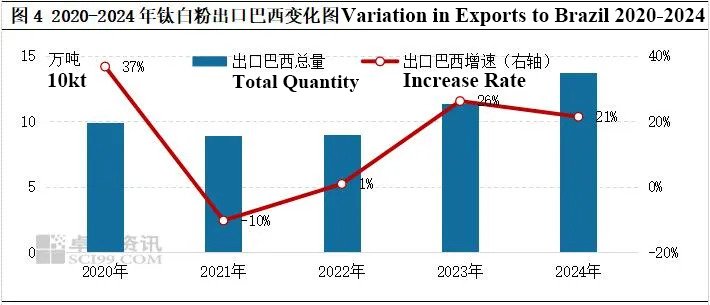

Brazil

- Export Volume: From January to February 2025, China’s titanium dioxide exports to Brazil saw a significant decline, with a cumulative export volume of only 10,800 tons, nearly 50% lower year-on-year.

- Reasons for Decline: On October 21, 2024, Brazil decided to impose a temporary anti-dumping duty of $577.73 to $1,772.69 per ton on rutile titanium dioxide originating from China for no more than six months. Although there was no significant change in export volume for the whole of 2024, the impact of anti-dumping duties began to show in the data for January-February 2025.

Countries along the “Belt and Road” Initiative

Turkey: As a West Asian country under the “Belt and Road” initiative, Turkey’s demand for Chinese titanium dioxide has steadily increased, with an average annual growth rate of 22% over the past five years. From January to February 2025, Turkey’s cumulative import volume reached 20,300 tons, a 19% year-on-year increase, making it China’s second-largest export partner for titanium dioxide.

United Arab Emirates: In 2024, the UAE’s infrastructure development index score was 128, improving its ranking to fifth among countries participating in the “Belt and Road” initiative. The steady and rapid growth of its infrastructure has supported the continuous increase in titanium dioxide demand, with a remarkable 74% surge in imports from China in January-February 2025.

Others: Demand from other countries along the “Belt and Road,” such as South Korea, Indonesia, and Vietnam, is also growing, with Chinese titanium dioxide continuing to show good growth in these markets.

Changes in Export Patterns

Ranking Changes: From January to February 2025, there were significant changes in the rankings of China’s top ten titanium dioxide export partners. India maintained its first position, while Turkey rose to second. Under the framework of the “Belt and Road” initiative, several Southeast Asian and West Asian countries entered the top ten, while EU countries that previously imposed anti-dumping duties no longer appeared.

Impact of Anti-Dumping Policies: Comparing the trade volumes of the top ten export partners from January-February 2024 to those in January-February 2025, partners like the EU and Brazil, which imposed anti-dumping duties, saw a noticeable decline in import volumes. In contrast, partners like India, the UAE, and Turkey, which were not subjected to anti-dumping duties, experienced significant growth in imports. This indicates that anti-dumping policies have had a substantial impact on the export patterns of titanium dioxide.

Future Outlook

Challenges: India plans to impose anti-dumping duties at the end of March, and whether China’s titanium dioxide exports to India will see a drastic decline similar to those to the EU and Brazil remains to be observed. Additionally, the rise of global trade protectionism may continue to impact titanium dioxide export patterns.

Opportunities: China’s titanium dioxide exports will continue to seek more growth opportunities in countries along the “Belt and Road.” The ongoing development of infrastructure in these regions and supportive policies provide ample growth space for the titanium dioxide market.